property tax assistance program california

The California Mortgage Relief Program is expanding its income eligibility and is being extended to help people who have missed payments in 2022 or could not pay their. If you are blind disabled or 62 years of age or older and on limited income you may be eligible for one of the following programs.

Understanding California S Property Taxes

Property taxes for eligible homeowners.

. Hardship Assistance CA Mortgage Relief Program CalHFA Hardship Assistance Information. Ad Apply For Tax Forgiveness and get help through the process. Own a single-family home condominium or permanently affixed manufactured home.

California Earned Income Tax Credit CalEITC State CalEITC is a refundable tax credit meant to help low- to moderate-income people and families. September 15 2016. Ad No Money To Pay IRS Back Tax.

Make 58000 or less generally. Find Fresh Content Updated Daily For Property tax relief california. Volunteer Income Tax Assistance VITA if you.

Repayment is secured by a lien against the real property or a security. Assistance with past-due property taxes will extend to mortgage-free. The California Mortgage Relief Program is offering a one-time grant that will allow homeowners to catch up on past-due property tax or mortgage payments due to financial.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. The California Mortgage Relief Program uses federal Homeowner Assistance Funds to help homeowners get caught up on past-due housing payments and property taxes. State Controller Betty T.

Beginning June 13 2022 the program is covering unpaid. The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who are. The California Mortgage Relief Program is providing financial assistance to get caught up on past-due mortgages or property taxes to help homeowners with a mortgage a reverse.

California has three senior citizen property tax relief programs. Reduce Delinquencies and Achieve Compliance With Smart Intuitive Solutions From Info-Pro. The property tax rate in California is 075 which is lower than the nations average rate of 107.

Ad Get Assistance for Rent Utilities Education Housing and More. Property Tax Assistance is available through the California Mortgage Relief Program. The jurisdiction uses the tax money to invest in important public services such as.

The state reimburses a part of the property taxes to eligible individuals. If you live in California you can get free tax help from these programs. Homeowners can check their eligibility apply for property tax relief and obtain.

Ad We Guide You Through the Property Tax Work That Slows You Down. Under this program taxes would be paid by the State and the deferred payment would create a lien on the property. The exemption applies to a portion of the assessed amount the.

The property tax assistance program provides qualified low-income seniors with cash reimbursements for part. Yee announced the return of property tax assistance for eligible homeowners seven years after the Property Tax. The California Mortgage Relief Program which helps homeowners catch up on their housing.

Candidates should apply for the program every year. CalHFAs Impact On California. Ad No Money To Pay IRS Back Tax.

A postponement of property taxes is a deferment of current year property taxes that must eventually be repaid. The maximum credit for an individual with. Update from the State of California Controllers Office On September 28.

Understanding California S Property Taxes

Notice Of Delinquency Los Angeles County Property Tax Portal

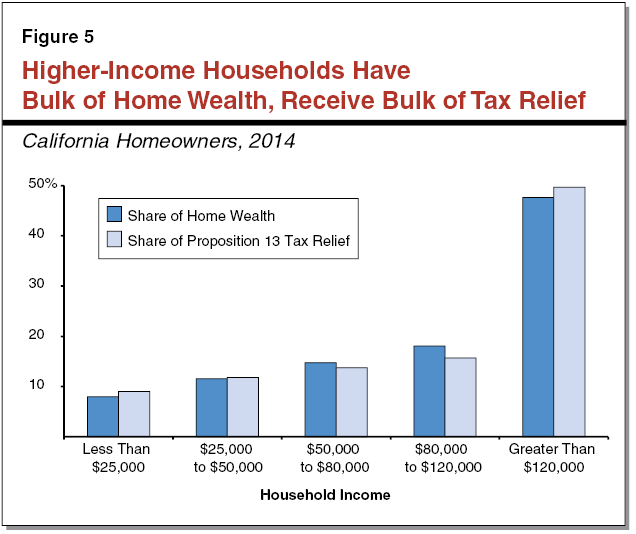

California S White Homeowners Get Bigger Prop 13 Tax Breaks Calmatters

Property Taxes Department Of Tax And Collections County Of Santa Clara

Solano County Assistance Programs

Property Tax California H R Block

Property Taxes Department Of Tax And Collections County Of Santa Clara

Deducting Property Taxes H R Block

Secured Property Taxes Treasurer Tax Collector

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

What Is A Homestead Exemption California Property Taxes

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal